http://support.sas.com/resources/papers/proceedings12/163-2012.pdf

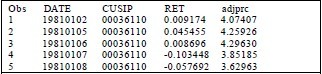

文章比较了较传统的股票分析方法:移动平均MA,相对强度指标RSI,布连线;处于数据的连续和完整,文章选取1981.1.2-2010.12.31时间内纽交所都进行交易的股票数据,共计355只个股。数据包含了一下变量:日期date,股票的ID,日收益RET,股票调整价格ADJPRC,格式如下如:

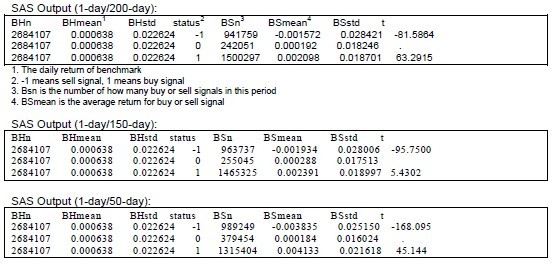

355只股票的平均日收益0.0638%,标准差sd=2.2624%.如果预测收益超过阀值就意味着该方法有效。

1.移动平均方法

1日/2日/5日移动平均线为短期均线,50日/150日/200日为长期均线。当短期均线从下向上穿越长期均线,作为买入信号;反之为卖出信号。假设投资者持有或卖出股票严格遵守交易信号进行操作,这种策略为“变长移动平均-VMA”;如果投资者按照固定天数持有或卖出股票,这种策略称为“定长移动平均-FMA”。

data MA;

set summer.sample;

MA2 = adjprc;

MA5 = adjprc;

MA50 = adjprc;

MA150 = adjprc;

MA200 = adjprc;

run;

proc sort data = MA;

by cusip date;

run;

%macro calave(days);

%do i = 1 %to &days-1;

data MA;

set MA;

MA&days = MA&days + lag&i(adjprc);

if &i = &days-1 then MA&days = MA&days/&days;

if &i = &days-1 then do;

if &days = 2 and date<mdy(01,05,81) then MA2 = .;

if &days = 5 and date<mdy(01,08,81) then MA5 = .;

if &days = 50 and date<mdy(03,13,81) then MA50 = .;

if &days = 150 and date<mdy(08,05,81) then MA150 = .;

if &days = 200 and date<mdy(10,15,81) then MA200 = .;

end;

run;

%end;

%mend;

%calave(2)

%calave(5)

%calave(50)

%calave(150)

%calave(200)

data summer.MovingAverage;

set MA;

run;

下面的代码测试VMA ,该例测试了1日/200日,1日/150日,1日/50日的短线长线策略。

data MAresult;

set summer.movingaverage;

run;

proc means data = MAresult noprint;

var ret;

output out = buyandhold n = BHn mean = BHmean std = BHstd;

run;

data MAresult;

set MAresult;

if adjprc=. or MA200=. then status = 0;

else if adjprc>MA200*1.01 then status = 1; *VMA buy(1,200,0.01);

else if adjprc<MA200*0.99 then status = -1; *VMA sell(1,200,0.01);

else status = 0;

if adjprc=. or MA50=. then status = 0;

else if adjprc>MA50*1.01 then status = 1; *VMA buy(1,50,0.01);

else if adjprc<MA50*0.99 then status = -1; *VMA sell(1,50,0.01);

else status = 0;

if adjprc=. or MA150=. then status = 0;

else if adjprc>MA150*1.01 then status = 1; *VMA buy(1,150,0.01);

else if adjprc<MA150*0.99 then status = -1; *VMA sell(1,150,0.01);

else status = 0;

run;

proc sort data = MAresult;

by status;

run;

proc means data = MAresult noprint;

var ret;

by status;

output out = buyandsell n = BSn mean = BSmean std = BSstd;

run;

data VMAfinal; *VMA final result!;

merge buyandhold buyandsell;

by _TYPE_;

drop _FREQ_ _TYPE_;

if status ~= 0 then

t =(BSmean-BHmean)/sqrt(BHstd*BHstd/BHn+BHstd*BHstd/BSn);

run;

测试结果如下:

2.相对强弱指标策略:Relative Strength Index

RSI的原理简单来说是以数字计算的方法求出买卖双方的力量对比,譬如有100个人面对一件商品,如果50个人以上要买,竞相抬价,商品价格必涨。相反,如果50个人以上争着卖出,价格自然下跌。强弱指标理论认为,任何市价的大涨或大跌,均在0-100之间变动,根据常态分配,认为RSI值多在30-70之间变动,通常80甚至90时被认为市场已到达超买状态,至此市场价格自然会回落调整。当价格低跌至30以下即被认为是超卖状态,市价将出现反弹回升。具体的公式:

• RS = Ave. Gain / Ave. Loss in prior n days;

• RSI = 100 – 100 / (1+RS)

文章计算了14日RSI,下面的代码系在SAS中定义RSI:

*define RSI in SAS

RS = Ave. Gain / Ave. Loss in prior n days

RSI = 100 – 100 / (1+RS);

data RSI;

set RSI;

by cusip;

ladjprc = lag(adjprc);

if adjprc>ladjprc then gain = adjprc-ladjprc;

if adjprc<ladjprc then loss = ladjprc-adjprc;

if first.cusip then do;

gain = .;

loss = .;

end;

retain days 0;

days+1;

if first.cusip then days = 1;

if gain = . then gain = 0;

if loss = . then loss = 0;

retain sumgain 0;

sumgain = sumgain + gain;

retain sumloss 0;

sumloss = sumloss + loss;

if days=15 then do;

AveGain = (sumgain-gain) / 14;

AveLoss = (sumloss-loss) / 14;

RS = AveGain / AveLoss;

RSI = 100-100/(1+RS);

end;

drop sumgain sumloss;

run;

%macro calRSI();

%do i=16 %to 7570;

data RSI;

set RSI;

lAveGain = lag1(AveGain);

lAveLoss = lag1(AveLoss);

if days = &i then do;

AveGain = (lAveGain*13+gain)/14;

AveLoss = (lAveLoss*13+loss)/14;

RS = AveGain / AveLoss;

RSI = 100-100/(1+RS);

end;

%end;

%mend;

%calRSI;

data summer.RSIresult;

set RSI;

run;

下面的代码测试了“变长RSI”(Variable-Length RSI,VRSI),定义超买信号为RSI>80,RSI<60时投资者弱卖;RSI<20为超卖信号,RSI>40强卖信号。

data VRSIB;

set RSIresult;

by cusip;

drop status;

retain period 0;

if first.cusip then period = 0;

if RSI<20 then period = 1; *RSI<20 buy and until RIS>40;

if RSI>40 then period = 0;

RealPeriod = lag(period);

if RealPeriod = 0 then delete;

run;

data VRSIS;

set RSIresult;

by cusip;

drop status;

retain period 0;

if first.cusip then period = 0;

if RSI>80 then period = 1; *RSI>80 sell and until RIS<60;

if RSI<60 then period = 0;

RealPeriod = lag(period);

if RealPeriod = 0 then delete;

run;

proc means data = VRSIB;

var ret;

run;

proc means data = VRSIS;

var ret;

run;

结果如下:

3.布连线策略BOLLINGER BANDS STRATEGY (BOLL)

BOLL指标的计算公式 :

中轨线=N日的移动平均线

上轨线=中轨线+两倍的标准差

下轨线=中轨线-两倍的标准差

BOLL指标的计算过程

(1)计算MA : MA=N日内的收盘价之和÷N

(2)计算标准差MD:MD=平方根N日的(C-MA)的两次方之和除以N

(3)计算MB、UP、DN线 :MB=(N-1)日的MA,UP=MB+2×MD,DN=MB-2×MD

文章,以20日作为移动平均日期,2(4)倍标准差作为上下轨与中轨距离。股价在大于上轨为卖出信号,股价低于下轨为买入信号。作者下面的代码测试了“变长的布林线策略”。

/*The following program illustrates how we define the Bollinger Bands Strategy in SAS*/ data BB; set summer.sample; MA20 = 0; run;

proc sort data = BB; by cusip date; run;

%macro calave(days); %do i = 1 %to &days; data BB; set BB; MA&days = MA&days + lag&i(adjprc); if &i = &days then MA&days = MA&days/&days; if &i = &days then do; if &days = 20 and date<mdy(02,05,81) then MA20 = .; end; run; %end; %mend; %calave(20)

%macro sd; proc delete data=all; run;

%do firstobs = 1 %to (2684248-20); %let lastobs = %eval( &firstobs + 19); proc means data=BB(firstobs=&firstobs obs=&lastobs) noprint; var adjprc; output out=tempfile stddev=sd20; run; proc append base=all data=tempfile; run; %end; %mend sd; %sd;

data summer.BBand; set all; run;

下面的代码测试了布林线策略:

/*The following program evaluates the variable and fixed Bollinger Bands: Program 3B:*/

data BB;

set summer.finalBB;

upperband = MA20+2*sd20;

lowerband = MA20-2*sd20;

upperband1 = MA20+1*sd20;

lowerband1 = MA20-1*sd20;

if adjprc>upperband then status = -1;

else if adjprc<lowerband then status = 1;

else status = 0;

run;

data VBBB;

set BB;

by cusip;

drop status;

retain period 0;

if first.cusip then period = 0;

if adjprc<lowerband then period = 1;

if adjprc>lowerband1 then period = 0;

RealPeriod = lag(period);

if RealPeriod = 0 or RealPeriod = . then delete;

run;

data VBBS;

set BB;

by cusip;

drop status;

retain period 0;

if first.cusip then period = 0;

if adjprc>upperband then period = 1;

if adjprc<upperband1 then period = 0;

RealPeriod = lag(period);

if RealPeriod = 0 or RealPeriod = . then delete;

run;

proc means data=VBBB;

var ret;

run;

proc means data=VBBS;

var ret;

run;

测试结果如下: